Home / Consolidation Loan

Streamline Your Debt with a Brightline Consolidation Loan

- Lower Monthly Payments

- Simplified Payments

- Improved Credit Score

*Applying won’t affect your credit score.

Why Choose BrightUSA for Consolidation Loans?

Effortless Application, Professional Guidance

Easily navigate our straightforward application process with personalized support from our

experienced team.

Tailored Loan Solutions

Collaborate with our specialists to design loan terms that best suit your debt consolidation

needs and financial goals.

No Prepayment Penalties

Take advantage of the flexibility to pay off your consolidation loan early without incurring extra

charges.

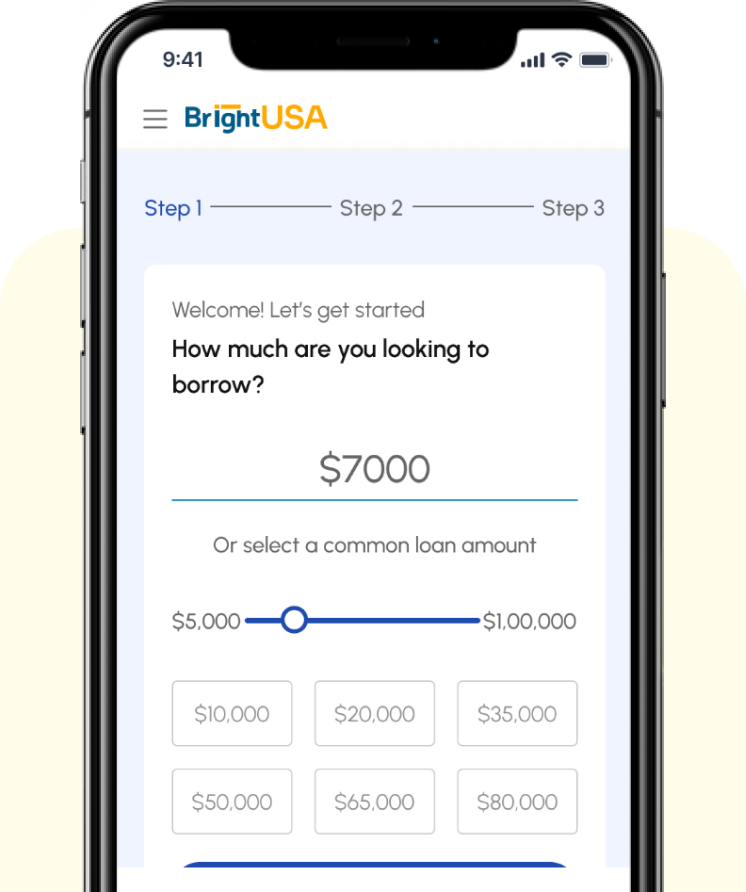

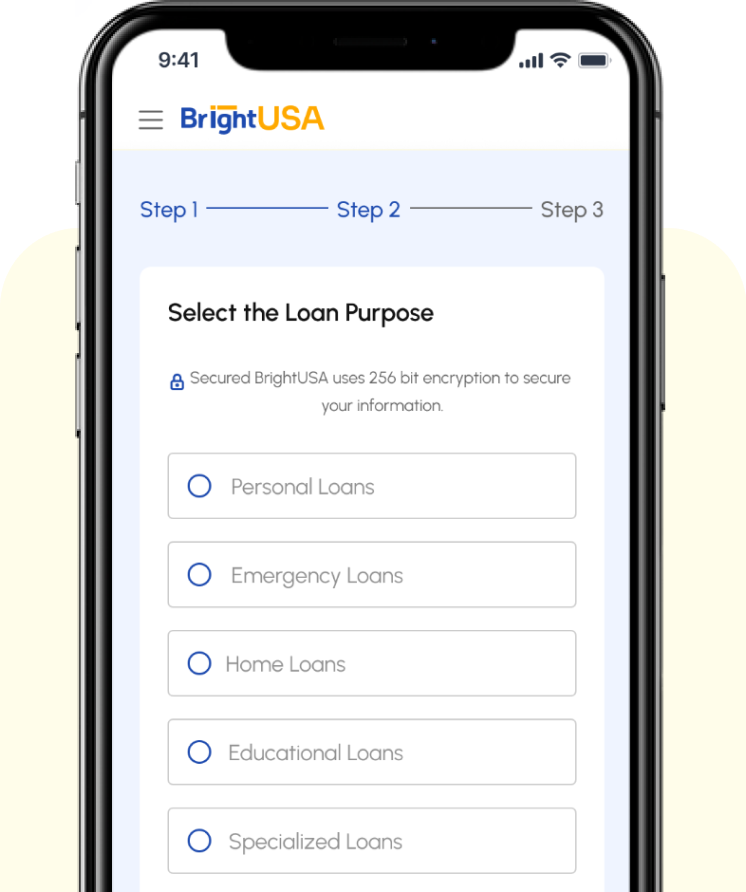

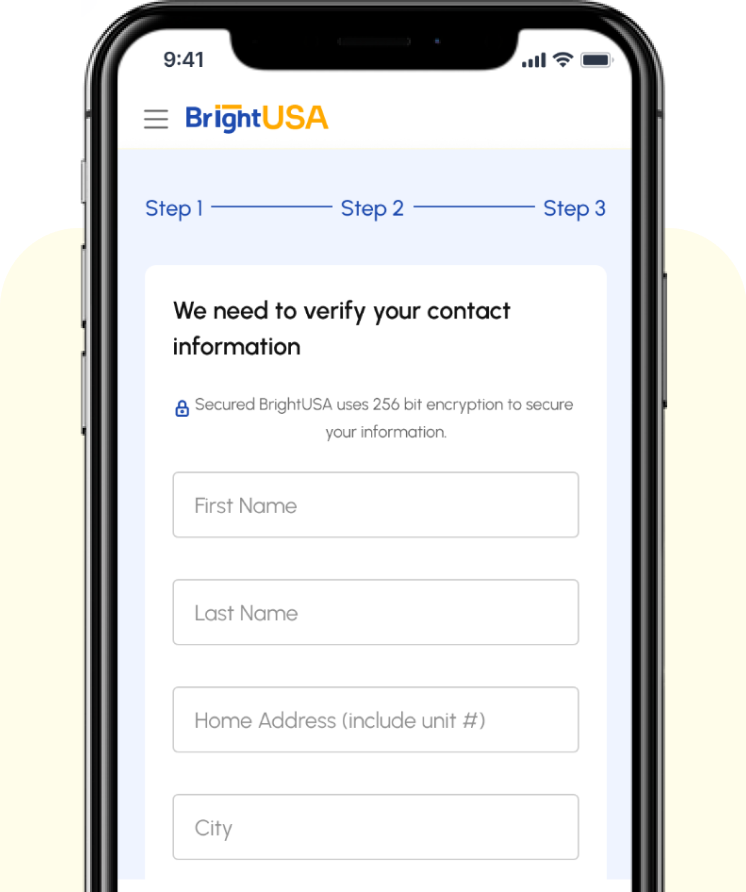

Navigate Your Loan Choices in Three Simple Steps

Provide Your Details

Begin by completing our easy form with your essential information. Tell us your preferred time for a call, ensuring a seamless experience. Your convenience is our priority, and we schedule our expert loan advisors to align with your availability.

Outline Your Financial Ambitions

Engage in a conversation with one of our knowledgeable loan consultants. Together, you’ll explore your financial aspirations, various loan options, and the most suitable terms and rates for your situation. We can smoothly transition into the application phase for prompt approval if you meet the qualifications and select an appropriate loan.

Anticipate Your Loan Outcome

The final step is the most exciting: awaiting your rapid loan approval decision. For most of our approved loans, 99% of the funds are disbursed directly to your account within just one business day. Embark on your path to financial empowerment today!

Frequently Asked Questions About Consolidation Loans

We’ve answered a few common questions to help you get started with simplifying your finances.

If you have more, our team is here to assist—don’t hesitate to reach out!

What is a consolidation loan?

A consolidation loan allows you to combine multiple debts into a single loan, simplifying your payments and potentially reducing your interest rates.

How do I apply for a consolidation loan with Brightline?

Applying is easy and can be done online. Simply complete the application with details of your existing debts, and our team will guide you through the next steps

Do I need a good credit score to qualify?

While a good credit score can help, Brightline considers your overall financial situation, offering solutions for a range of credit profiles to help you manage your debt.

How much can I borrow with a consolidation loan?

The amount you can borrow depends on your creditworthiness and the total amount of debt you wish to consolidate. Brightline offers flexible loan amounts to suit your needs.

What are the interest rates for consolidation loans?

Interest rates are personalized based on your credit profile and loan amount. Brightline offers competitive rates to help you save on interest and manage your debt effectively.

How soon can I get approved and receive the funds?

Approvals are typically quick, with many applicants receiving a decision within minutes. Once approved, funds are usually disbursed promptly to pay off your existing debts.

Are there any fees associated with consolidation loans?

Brightline values transparency, ensuring there are no hidden fees. Any applicable charges will be clearly communicated during the loan process.

Can I consolidate different types of debt?

Yes, Brightline’s consolidation loans can be used to combine various types of debt, including credit card balances, personal loans, and other unsecured debts.

Is there a penalty for paying off my loan early?

No, there are no prepayment penalties with Brightline’s consolidation loans, allowing you to pay off your loan early without additional costs.

How do I manage my loan payments?

Managing your loan is simple with Brightline’s online portal, where you can set up automatic payments, track your progress, and make adjustments as needed.

Take Control of Your Finances with Confidence

Choose Brightline for Loans that Simplify Your Financial Life

Begin your journey toward financial stability with Brightline. Our mission is to help you streamline your finances by offering personalized loan solutions that make debt management easier. Imagine a future with fewer payments, lower interest rates, and reduced financial stress. Brightline is your reliable partner in this journey, providing expert guidance and unwavering support