Home / Home Loan

Upgrade Your Home with a Home Improvement Loan

- Flexible Loan Amounts

- Adjustable Repayment Terms

- No Collateral Required

*Applying won’t affect your credit score.

Why Choose USABrightline for Home Renovation Loans?

Simple Application, Professional Support

Navigate our easy loan application process with confidence, guided by our expert team every step of the way.

Customized Loan Options

Work with our specialists to create loan terms that align with your specific home renovation

needs and financial goals.

No Prepayment Penalties

Enjoy the flexibility of paying off your renovation loan early, without any extra charges or

penalties.

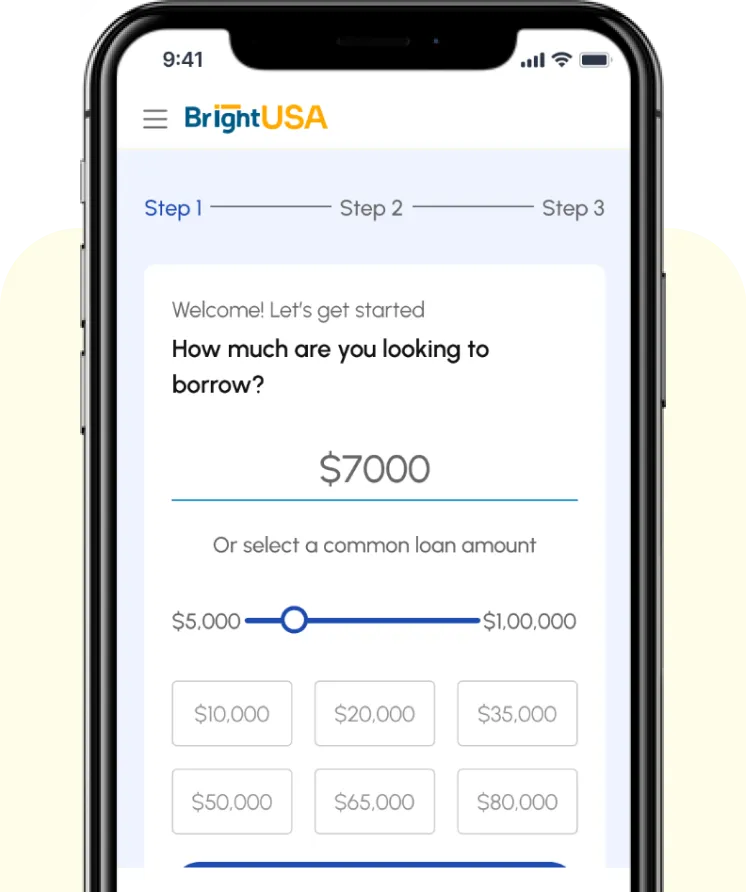

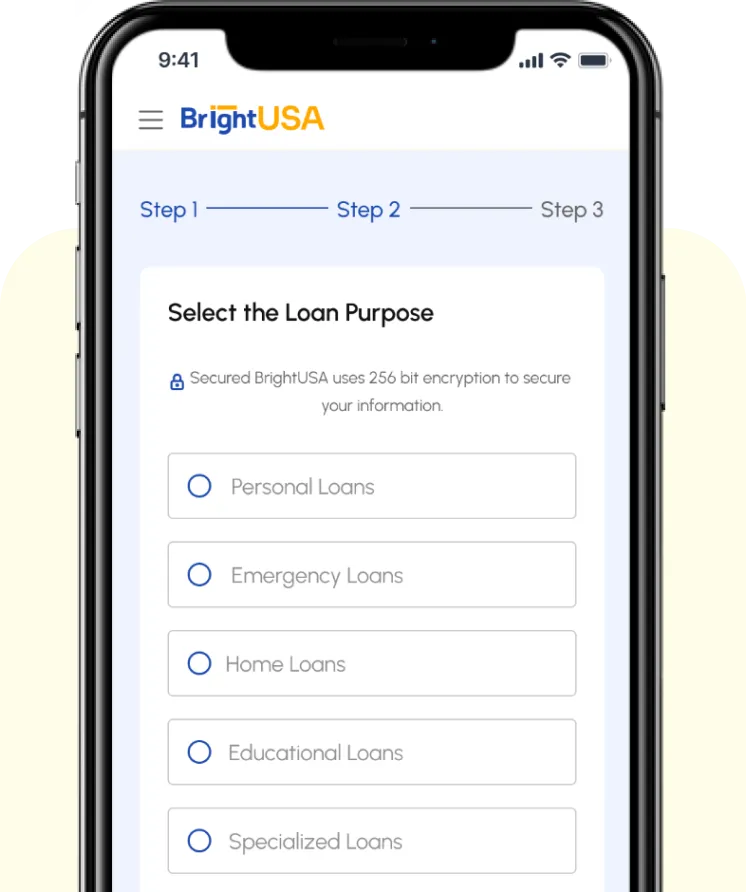

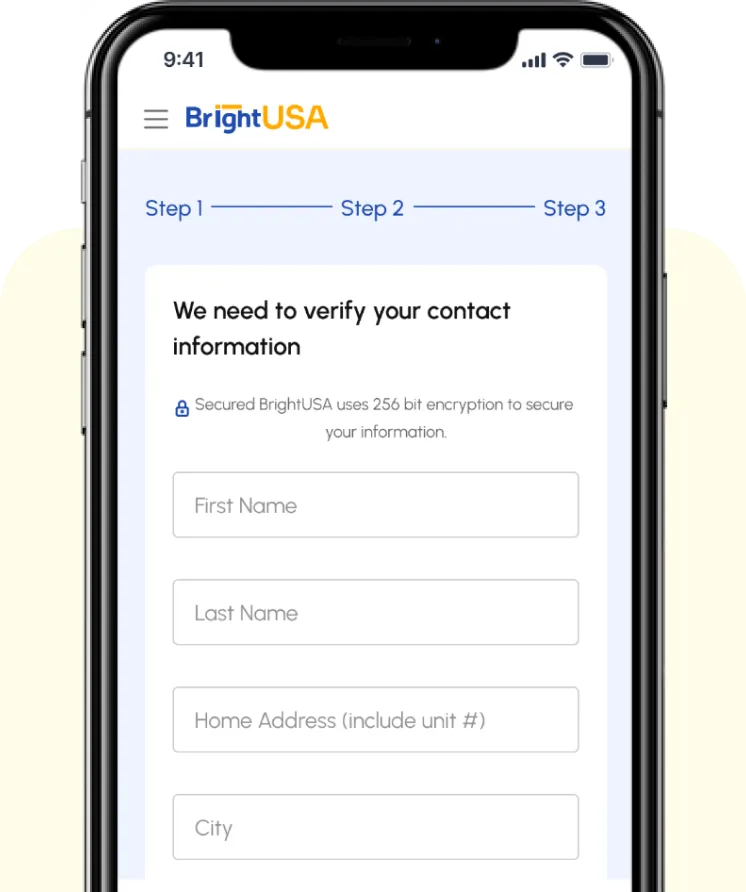

Navigate Your Loan Choices in Three Simple Steps

Provide Your Details

Begin by completing our easy form with your essential information. Tell us your preferred time for a call, ensuring a seamless experience. Your convenience is our priority, and we schedule our expert loan advisors to align with your availability.

Outline Your Financial Ambitions

Engage in a conversation with one of our knowledgeable loan consultants. Together, you’ll explore your financial aspirations, various loan options, and the most suitable terms and rates for your situation. We can smoothly transition into the application phase for prompt approval if you meet the qualifications and select an appropriate loan.

Anticipate Your Loan Outcome

The final step is the most exciting: awaiting your rapid loan approval decision. For most of our approved loans, 99% of the funds are disbursed directly to your account within just one business day. Embark on your path to financial empowerment today!

Frequently Asked Questions About Home Renovation Loan

We’ve answered a few common questions to help you get started on your home improvement

project. If you have more, our team is here to assist—don’t hesitate to reach out!

What is a home renovation loan?

A home renovation loan is a type of financing designed specifically to cover the costs of home improvement projects, such as remodeling, repairs, or upgrades to your property.

How do I apply for a home renovation loan with BrightUSA?

Applying is simple and can be done online. Just complete the application form with your project details, and our team will guide you through the next steps to secure your loan.

Do I need a good credit score to qualify?

While a good credit score can help you secure better rates, BrightUSA considers your entire financial situation, offering options for various credit profiles to help fund your home improvements.

How much can I borrow for my home renovation project?

The loan amount you can borrow depends on your creditworthiness and the scope of your project. BrightUSA offers flexible amounts to ensure you have the funds needed to complete your renovation

What are the interest rates for home renovation loans?

Interest rates are personalized based on your credit profile and loan amount. BrightUSA offers competitive rates, ensuring affordable financing for your home renovation.

How soon can I get approved and receive the funds?

Approval is typically quick, with many applicants receiving a decision within minutes. Once approved, funds are often disbursed promptly, allowing you to start your project without delay.

Are there any fees associated with home renovation loans?

BrightUSA is transparent about any fees involved. There are no hidden costs, and any applicable fees will be clearly communicated during the loan process.

Can I use a home renovation loan for any type of project?

Yes, BrightUSA’s home renovation loans can be used for a wide range of projects, including kitchen remodels, bathroom upgrades, roofing, or even landscaping.

Is there a penalty for paying off my loan early?

No, there are no prepayment penalties with BrightUSA’s home renovation loans. You can pay off your loan at any time without incurring extra fees.

How do I manage my loan payments?

Managing your loan is easy through BrightUSA’s online portal, where you can set up automatic payments, track your progress, and make adjustments as needed.

Start Your Home Renovation Journey with Confidence

Choose USABrightline for Loans that Empower Your Home Transformation

Take the first step towards your dream home with USABrightline. Our mission is to provide you with personalized loan solutions that support your renovation goals. Picture a future where your perfect kitchen, updated bathroom, or expanded living space is within reach. USABrightline is your trusted partner in this journey, offering expert guidance and unwavering support.